2025 Open Enrollment for your Albertsons Companies, Inc. benefits ended on November 15, 2024. Watch for your 2025 Open Enrollment Confirmation Statement mailed to your home in December. Your Confirmation Statement will show your benefits and paycheck deductions along with covered dependents starting January 1, 2025. Your Confirmation Statement will also show any beneficiary designations on file in myACI Benefits for Life and Accidental Death and Dismemberment Insurance.

Jump to Sections on This Page

- Open Enrollment Aftercare

- Watch the 2025 Open Enrollment Video

- What’s New in 2025?

- Open Enrollment and HSA Webinars

- Access a 2025 Benefits Guide and Rate Sheet

- Say Hello to ALEX, Your Online Benefits Counselor

- We Want Your Opinion on the 2025 Open Enrollment Communications

- How to Enroll During Open Enrollment

Now that 2025 Open Enrollment is closed, there are several important things that will be happening that you should know about.

Open Enrollment Webinars

The 2025 Open Enrollment live webinars are now complete. If you missed a live webinar, click on the link below to watch a recorded session available any time. You’ll learn everything you need to know about Open Enrollment, including what’s new for 2025, how to enroll using myACI Benefits, where to find benefits and enrollment resources, and more.

Click here to watch a recorded Open Enrollment Webinar.

HSA Webinars

The 2025 HSA Basics and HSA Advanced live webinars are now complete. Recorded sessions of the HSA webinars are not available due to Fidelity requirements.

Click here for more information about a Health Savings Account.

Click here to download HSA FAQs.

Say Hello to ALEX, Your Online Benefits Counselor

ALEX is your online benefits counselor who will explain your benefits in simple, easy-to-understand language. ALEX can help you choose the benefits and coverage options that will meet your needs and your budget. ALEX has been updated for 2025 and is ready to talk to you about next year’s benefits Learn more.

How to Enroll During Open Enrollment

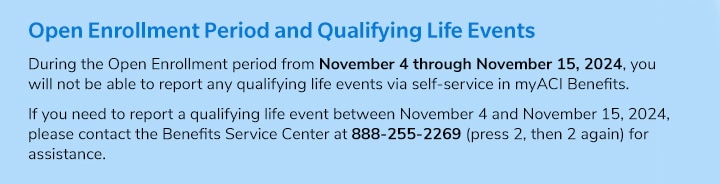

During the 2025 Open Enrollment period (Nov. 4-15), you will use myACI to enroll or make changes to your benefits, update dependent information and verify or update your beneficiary designations for life and accidental death and dismemberment (AD&D) insurance.

When you’re ready to enroll, follow these steps:

- Sign in at myACI.albertsons.com.

- From the Me page, click on the Benefits tile.

- Click on Review Your Covered Dependents and Beneficiaries tile to view the family members that can be covered under your benefits or designated as beneficiaries for life insurance.

- Click on the blue button that says Click here to continue your enrollment changes.

- Follow the onscreen instructions to enroll or update your coverage elections.