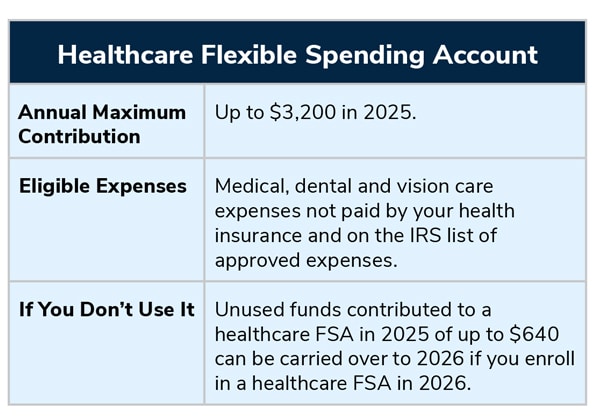

A healthcare flexible spending account (FSA) gives you a tax break on eligible medical, dental and vision expenses that are not covered by other plans.

A healthcare FSA can help you save money on eligible healthcare expenses and lower your taxable income. By anticipating your expenses and arranging for deductions to be made from your paycheck each pay period, you lower your tax bill. In 2025, you can set aside up to $3,200 on a pre-tax basis.

Important

IRS rules do not allow you to contribute to a healthcare FSA if you are contributing to a health savings account (HSA). If you enroll in the HSA Plan or the Kaiser CA High Deductible HSA Plan, you will not be able to select a healthcare FSA.

If you have a healthcare FSA balance on 12/31/25, in order to carry over your balance into 2026 you must select the 2026 healthcare FSA during Open Enrollment and select a 2026 medical plan that does not include an HSA or waive medical coverage.

FSAs are administered by Health Equity.

https://healthequity.com/fsa

866-346-5800