Your contributions

For most associates, every dollar of eligible pay (up to 7%) you contributed to your 401(k) account in 2022, the Company contributed $0.50 to your account in Spring 2023.

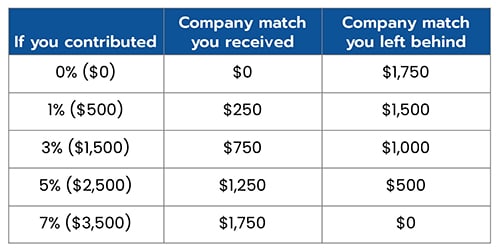

Are you missing out on free money?

If you completed the eligibility requirements to receive the Company match* and you contributed less than 7% of your eligible pay, you’re missing out on free money! Here’s an example of what you missed if your eligible pay was $50,000 in 2022.

See your Company match or enroll in the 401(k) Plan

To see your Company match amount, go to Fidelity NetBenefits® at www.netbenefits.com.

To sign-up for the 401(k) Plan, go to www.netbenefits.com or call a Fidelity representative at 866-956-3433.

Click here to go to the 401(k) page.

* Company contributions are available only to eligible participants. Eligibility to receive an annual Company contribution requires the completion of one year of service and 1,000 hours measured from your hire date to first anniversary or subsequent calendar year, if you did not complete 1,000 by your first anniversary. Some union groups are not eligible to receive the annual Company contribution. See the Albertsons Companies 401(k) Summary Plan Description for more information. Company contributions may vary from year to year. Contributions are subject to annual IRS dollar limits.