A dependent day care flexible spending account (FSA) gives you a tax break on eligible day care or elder care expenses while you are working.

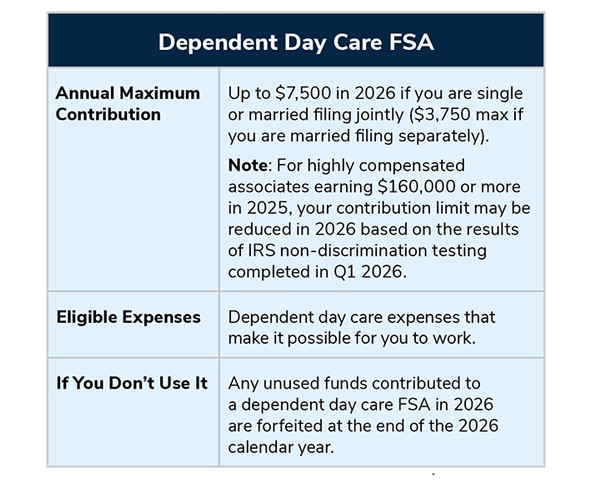

A dependent day care FSA allows you to pay for eligible day care or elder care expenses while you are working. You can set aside up to $7,500 each plan year on a pre-tax basis to cover the cost of dependent day care expenses.

The amount you contribute to a dependent day care FSA cannot be greater than your income or your spouse’s income, whichever is less. If your spouse contributes to a dependent day care FSA through his or her employer, your combined contributions may not exceed $7,500.

FSAs are administered by HealthEquity.

https://healthequity.com/fsa

866-346-5800