Learn what happens to your benefits when you leave Albertsons Companies or you do not work enough hours to continue to be eligible for benefits through the Company.

If you’re planning to leave Albertsons Companies or you do not work enough hours to maintain benefits eligibility, it’s important to understand what will happen to your Company benefits. In general, your benefit coverage ends on your last day of employment or the date you are no longer eligible for benefits. For medical, dental and vision coverage and a few other benefit plans, you may have the option to continue your coverage at your own expense for a period of time. This option is called COBRA continuation coverage. You also have the option to select coverage through Stride Health if COBRA isn’t the right fit for you.

COBRA Continuation Coverage

You and your eligible dependents may be able to continue your medical, dental, vision and employee assistance program (EAP) through COBRA at your own expense if you:

- Have coverage on your last day of employment at the Company (or last day prior to a leave of absence if you don’t return to work), and

- Want to keep the same coverage you currently have.

Government regulations and your individual circumstances determine the length of time you’re eligible for COBRA coverage.

The Company will notify Health Equity, the COBRA administrator, of your right to elect COBRA continuation coverage. The COBRA administrator will mail COBRA information (including rates and enrollment instructions) to you within 10 days after they receive notification of your termination. If you don’t receive the notice, call Health Equity at 877-722-2667.

Stride Health Offers an Alternative to COBRA Continuation Coverage

If COBRA continuation coverage is not the right fit for your budget or needs, Albertsons has teamed up with Stride Health to offer a different solution. Stride helps you compare top federal and state marketplace insurance plans, uncover savings through subsidies and tax credits, and secure the best coverage—all in just minutes.

Why Choose Stride?

- Affordable plans: Stride users save an average of $447/month on health insurance with tax credits compared to full-price health plans.

- Apply in minutes: Find plans that cover your doctors and prescriptions, with easy side-by-side comparisons and tax credit guidance to simplify your choice

- Expert support: Need assistance? Stride’s licensed agents are available at no cost to help you find and enroll in the plan that best fits your needs.

Because your health coverage is ending, you qualify for a Special Enrollment Period (SEP) through the federal or state Marketplace. You have 60 days from the date your coverage ends to take advantage of Stride and enroll in a Marketplace health plan. If you do not enroll within this 60-day window, you may have to wait until the next annual Marketplace open enrollment period to secure coverage.

Stride is here to make sure you stay protected—with the support and guidance you need to find the right plan.

Download a Stride Health flyer.

Need Help?

If you have questions about your health coverage options, including COBRA and federal or state Marketplace plans, Stride’s dedicated team is here to support you.

Explore Your Coverage Options with Stride Health

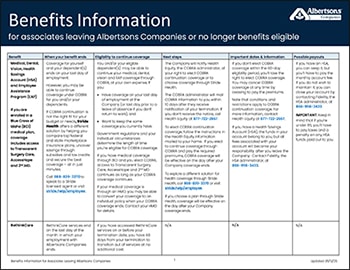

What You Need to Know When Benefits End

Download this flyer for details about:

- When coverage ends for each benefit plan.

- What to do if you would like to elect COBRA continuation coverage or coverage through Stride Health.

- What happens to any funds you have saved in Company accounts, like your 401(k), Health Savings Account (HSA) or Flexible Spending Accounts (FSAs).

- Other key details about what will happen to your benefits when you leave.